2010 was a year of learning for us and for our group members. One main comment made by many members was that, when they started meeting at the beginning of the year, they were really only interested in the money. However, over the course of the year, they received moral support, advice, sympathy and shared joy and laughter as well. Mpendulo became much more than ‘just money’.

One woman said, with quiet pride, “We call each other ‘sister’ now.” Another woman said, “When we meet, we talk and we laugh, I could do that all day. I look so forward to our meetings very month, it helps me to forget that my family is waiting for me at home to cook dinner and clean for them. Our [group] meetings are just for me.”

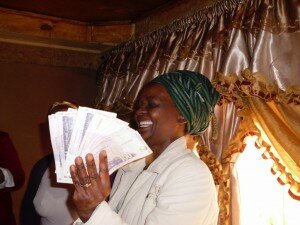

In December, our groups ‘shared out’ (liquidated) their savings and the interest they charged each other on loans. In total our 50 supervised groups with their 407 members saved R 546,195 (~$78,027). Their retained earnings (interest charged on loans and fines) amounted to R 298,541 (~$42,648). Total equity equaled R 845,276 (~$120,753). Their rate of return on savings came to 53.9%!!

In terms of impact, in 2010 our members have:

- more than doubled the amount they saved in 2009 (from an average of R 623 to R 1,342)

- increased their rate of return from 47.8% to 53.9%

- decreased the number of credit accounts at department stores by 25%

- decreased debt from money lenders (from 13.7% of members in 2009 to 6.9%)

- decreased credit owed to small neighbor shops and taverns (from 14.7% of members to 3.4%).

In addition, over 52% of our members were able to buy household assets and nearly 30% now operate some type of micro-business (typically related to petty trading).

All of the above will strengthen our members’ economic resilience.

We believe that our members will do even more in 2011. In our first week of operation after the festive season, we have trained 10 new groups! We have also added 2 new Training Officers.

As always, stay tuned for our next update!

ank you, thank you Martin and Beier Safety!!

ank you, thank you Martin and Beier Safety!!